You enter the annuity payment (\(PMT\)) as a negative number since you are paying the money. When you calculate the future value (\(FV\)), it displays a negative number, indicating that it is a balance owing. The present value of annuity table contains the factors used to determine an individual cash flow at one point in time.

When Is The Present Value Of Annuity Calculator Used?

The effects of compound interest—with compounding periods ranging from daily to annually—may also be included in the formula. Plots are automatically generated to show at a glance how present values could be affected by changes in interest rate, interest period or desired future value. An annuity table provides a factor, based on time, and a discount rate (interest rate) by which an annuity payment can be multiplied to determine its present value. For example, an annuity table could be used to calculate the present value of an annuity that paid $10,000 a year for 15 years if the interest rate is expected to be 3%.

Step 2 of 3

- We specialize in helping you compare rates and terms for various types of annuities from all major companies.

- Speak with one of our qualified financial professionals today to find out how an annuity can offer you guaranteed monthly income for life.

- The present value of an annuity represents the current worth of all future payments from the annuity, taking into account the annuity’s rate of return or discount rate.

- This can be an expected return on investment or a current interest rate.

It’s critical to know the present value of an annuity when deciding if you should sell your annuity for a lump sum of cash. Email or call our representatives to find the worth of these more complex annuity payment types. In order to understand and use this formula, you will need specific information, including the discount rate offered to you by a purchasing company. Calculating present value is part of determining how much your annuity is worth — and whether you are getting a fair deal when you sell your payments.

Create a Free Account and Ask Any Financial Question

If you pay upfront, however, you would pay $50,000 in today’s terms. Thus, you can either calculate the Present Value of an Annuity using the “full formula” or traditional formula, or you can use the Annuity Factor approach. To verify this, let’s calculate the Present Value of an Annuity for the example question we saw earlier in this article. Now, although we’ve solved this particular question using the formula/equation, there is another way.

In simpler terms, it tells you how much money the annuity will be worth after all the payments are received and compounded with interest. Using the present value formula helps you determine how much cash you must earmark for an annuity to reach your goal of how much money you’ll receive in retirement. how does the tax exclusion for employer There are several factors that can affect the present value of an annuity. Most of these are related to the annuity contract dealing with interest rates, guaranteed payments and time to maturity. But external factors — most notably inflation — may also affect the present value of an annuity.

Use your estimate as a starting point for a conversation with a financial professional. Discuss your quote with one of our trusted partners, who can explain the present value of your payments in more detail. You can plug this information into a formula to calculate an annuity’s present value. Simply put, the time value of money is the difference between the worth of money today and its promise of value in the future, according to the Harvard Business School.

In a general annuity, the payment frequency and the compounding frequency are not equal ([latex]P/Y \neq C/Y[/latex]). In this situation, the given interest rate must first be converted to the equivalent interest rate where the new compounding frequency equals the payment frequency. Using the equivalent interest rate, calculate the periodic interest rate [latex]i_2[/latex].

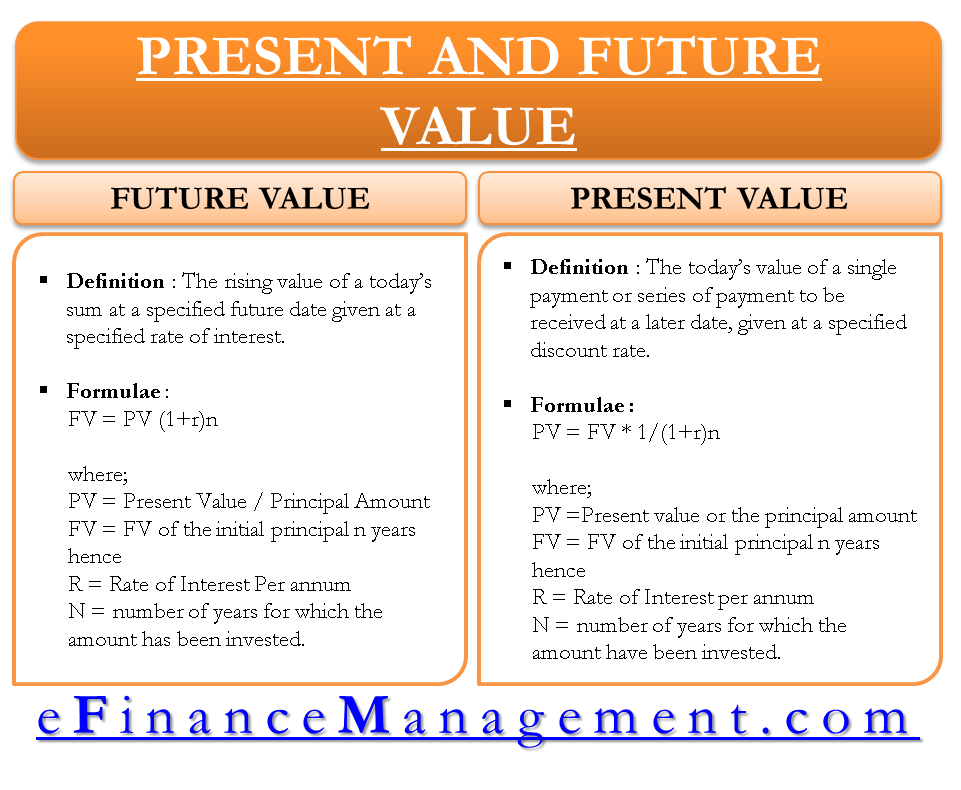

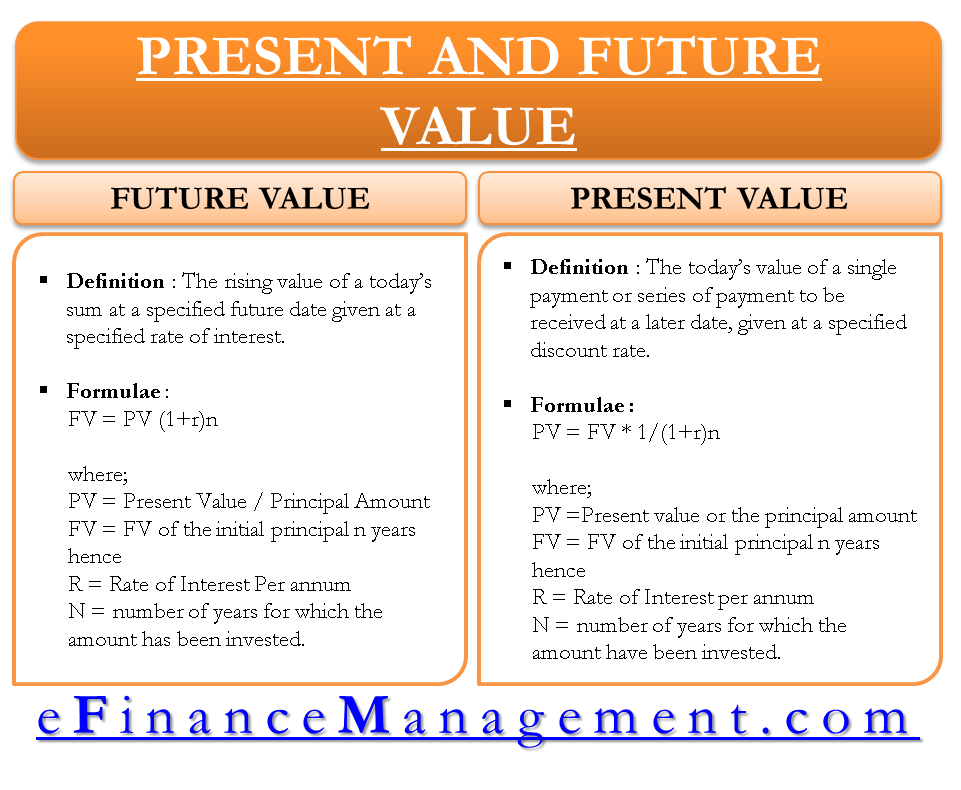

Future value, on the other hand, is a measure of how much a series of regular payments will be worth at some point in the future, given a set interest rate. If you’re making regular payments on a mortgage, for example, calculating the future value can help you determine the total cost of the loan. For example, you could use this formula to calculate the PV of your future rent payments as specified in your lease.

However, in practice and in everyday life annuity meaning takes a more explicit form. Buying an annuity usually refers to investment plans, for example insurance products, that provide a steady stream of income in retirement. For example, you can buy an annuity that requires a single upfront payment, or a series of payments to the insurance company. Then, the insurance company pays you either one lump-sum or multiple payments if the insurance pays out. What’s more, you can analyze the result by following the progress of balances in the dynamic chart or the annuity table. You can apply the annuity calculator for a wide range of annuities.

This can be done by discounting each cash flow back at a given rate by using various financial tools, including tables and calculators. Many websites, including Annuity.org, offer online calculators to help you find the present value of your annuity or structured settlement payments. These calculators use a time value of money formula to measure the current worth of a stream of equal payments at the end of future periods. The discount rate reflects the time value of money, which means that a dollar today is worth more than a dollar in the future because it can be invested and potentially earn a return.